I’ve always been a do-it-yourself investor. This habit started around age 19 with a series of ridiculous speculative trades in individual high-tech company stocks. “This stock is sure to go through the roof”, I would think, “because their products are so great.”

I’ve always been a do-it-yourself investor. This habit started around age 19 with a series of ridiculous speculative trades in individual high-tech company stocks. “This stock is sure to go through the roof”, I would think, “because their products are so great.”

This is a terrible way to invest.

But after a few early financial haircuts and the subsequent 20 years of reading an investment book or two every year, I’ve come to appreciate the much more boring and successful strategy of extremely long-term investing in extremely low cost index funds. Nowadays, I don’t just avoid trying to guess the short-term movements of individual stocks. I avoid looking at financial markets and news entirely, for weeks or months at a time.

This is a much better way to invest. In fact, doing just this will not only put you ahead of most average Joes, but you will also beat the vast majority of expensive personal financial advisers and professional investors as well. The reason is simply that you minimize the main sources of potential loss: human error and our flawed boom-bust psychology, fund fees, capital gains taxes, and broker commissions.

If we were to put a wide range of popular investing styles on a spectrum of effectiveness, it might look something like this:

Fig. 1: A few asset types with expected annual return after inflation.

You can see that we’re already up near the top of the chart. You can improve slightly on buy-and-hold-forever investing, but at this point it starts to take some work. To really beat it, you need to be a lifelong business prodigy who devours financial statements and human psychology in equal parts for most of your lifetime. (Note that most of us currently feel like stock geniuses because of the recent 20% annual gains in the overall market, but this all tends to average out over the decades and in reality you’ll do well to get 7% after inflation.)

For almost 40 years, Vanguard has been the place* to invest to get these high-on-the-chart results. As a member-owned firm, they have patiently operated with maximum integrity** and zero bullshit salesmanship while most financial firms leveraged, hedged, churned and charged their clients to maximize their own profits. I started my own Vanguard account in 1999 and have never looked back as multiple recessions and crises, booms and dividends have helped my small militia of green employees expand their ranks by hundreds of thousands of dollars.

For almost 40 years, Vanguard has been the place* to invest to get these high-on-the-chart results. As a member-owned firm, they have patiently operated with maximum integrity** and zero bullshit salesmanship while most financial firms leveraged, hedged, churned and charged their clients to maximize their own profits. I started my own Vanguard account in 1999 and have never looked back as multiple recessions and crises, booms and dividends have helped my small militia of green employees expand their ranks by hundreds of thousands of dollars.

But in recent years, technology and the latest startup company boom have brought new options for index fund investing. ETFs have delivered even lower expenses, easier transactions, and allowed Vanguard-like options to spread to Canada and European countries. Lightweight wealth managers like Future Advisor, Wealthfront, and Personal Capital deliver their own takes on index investing, with more service than Vanguard in exchange for moderate cost. Then there is Betterment, which appeared on my radar when I discovered some financially savvy friends were entrusting the company with big chunks of their wealth (Jesse Mecham and the Mad Fientist among them).

So Why did I Pick Betterment?

In two words, technology and psychology are what attracted me to this company. At the core, Betterment is just a fancy frontend for Vanguard funds – when you invest with Betterment, you end up owning Vanguard funds just like a wise person would already do. But they add value by automating two things that actually allow you to earn and keep more money: automatic portfolio rebalancing, and tax loss harvesting. They do this for a fee that amounts to roughly $150 per $100,000 invested. I expect the benefits to be substantially greater than that, meaning it should prove to be a profitable choice if I have done the homework right.

In two words, technology and psychology are what attracted me to this company. At the core, Betterment is just a fancy frontend for Vanguard funds – when you invest with Betterment, you end up owning Vanguard funds just like a wise person would already do. But they add value by automating two things that actually allow you to earn and keep more money: automatic portfolio rebalancing, and tax loss harvesting. They do this for a fee that amounts to roughly $150 per $100,000 invested. I expect the benefits to be substantially greater than that, meaning it should prove to be a profitable choice if I have done the homework right.

On top of that, their mobile and web-based interface make contributing and watching your growing ‘stash a lot of fun, which is a big part of the battle. But your interaction with the company remains in the digital realm – no adviser will be making personal calls to offer hand-holding and warm guidance. This works well for my typical engineer’s personality – I answer the phone for my mother, my wife, and a few close pals. The rest of the world can send me an email or put their information on a website. I’ll go read your site if I want your information, thanks very much.

What is Rebalancing and Tax Loss Harvesting Anyway?

Rebalancing means maintaining your original mix of stocks, bonds and other bits of the world economy in a strategic proportion. If one class goes up while another goes down, the system automatically sells a small portion of the winners and/or buys more of the discounted assets. On average this amounts to systematically buying low and selling high, which improves your returns slightly over the years, as explained in my older post on Asset Allocation.

In the normal course of all this rebalancing, Betterment will end up selling some index fund shares for you at a profit, which means capital gains taxes. This can be cleverly offset by selling other funds that have lost money in the same year, but then using that money to buy other funds that still allow you to own those same companies. This is called Tax Loss Harvesting.

You can’t do this trick by just selling and re-buying the same stock in the last week of every December: that is called a “wash sale” and the IRS disallows it. But with today’s wealth of interchangeable funds and within the whole scheme of automatic asset allocation, it is a perfectly valid strategy that Betterment estimates could improve the performance of a non-retirement account by about 0.77% annually, which is again several times the fee they charge.

The Experience of Betterment

Shortly after becoming convinced of the benefits, I had the unexpected good fortune of meeting with a crew of Betterment workers, including co-founder Jon Stein. Over dinner I was pleased to absorb the realness of the company culture – technical and pragmatic, and completely free of the stuffed-shirt hype that has been pervasive in most of my peeks into the financial services industry. They answered every question I could throw at them, and then lent me one of their engineers to handle any follow-up technical questions that might come up in further research.

At last I decided to take the plunge, and I signed up for an account just as any new customer would do. The reassuring simplicity of it was a joy. I did the basic account setup, linked in the checking account, and within a day I was able to transfer the last $100,000 of leftover cash from my recent house sale into productive investments where it should be.

What I Bought

Betterment is designed to make things simple for you, even while they do some pretty sophisticated management in the background. They start with a brief questionnaire on how long until you retire, and your financial goals. In the end, this translates to a ratio of stocks to bonds, and people closer to retirement get more bonds because stability is often preferred over the higher returns of stocks.

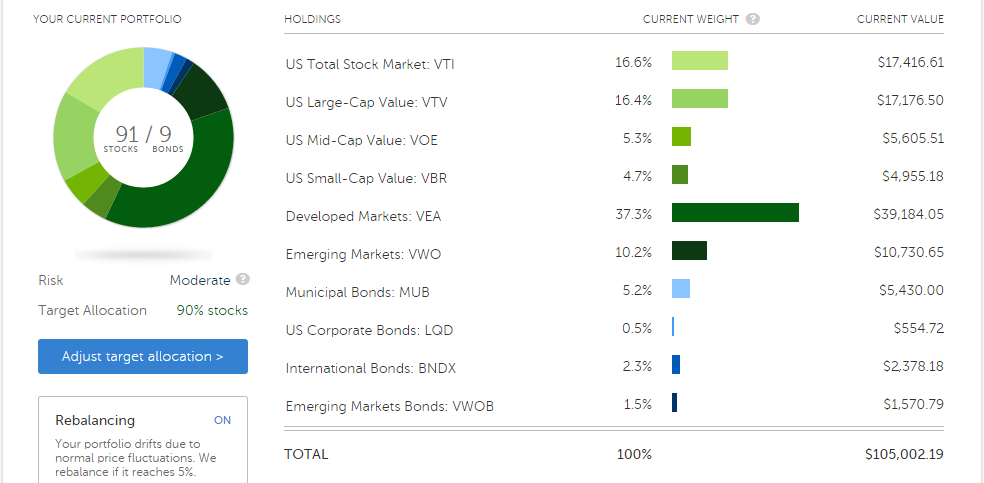

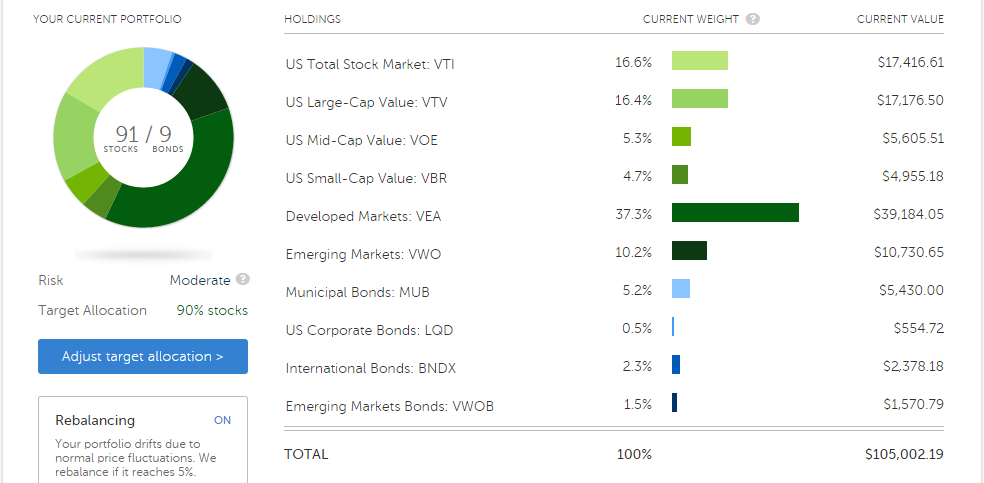

However, I retired 10 years ago and I still don’t care at all about stability, because we have sufficient safety margin to allow (and even benefit from) greater volatility. So I overrode the system and selected “90% stocks, 10% bonds”. The portfolio ended up like this:

My $100k Betterment portfolio (which has since drifted up to $105k) is balanced across 10 Vanguard funds.

A Slew of Educational Emails

An unexpected benefit of the process has been enrollment in what I would call “Betterment University”. Since starting the account I have received no fewer than fifteen emails from the company’s system, nicely timed to be easily digestible in my limited email schedule. Some of them were just status updates: “Congratulations on funding your account / Your pricing plan has been upgraded”, etc. But others were concise tutorials on investing itself: “Explore Betterment’s historical performance / Why market timing is even more dangerous than you think / How we use dividends to keep your tax bill low.”

Vanguard does the same thing to an extent, but they tend to focus on drawn-out webinars and the presentation is less approachable. I look at Betterment as being a service to get started, plunge straight into top-tier investing, and then learn about what you’re doing in the coming months after you’ve already done it. For the typical beginner with no idea where to start, this can be an ideal approach since fear of starting often keeps many of us in savings accounts for far too long.

Where To Go From Here

I’m excited to watch this investment carefully over the coming years. While I’m not expecting magical performance, I do expect Betterment’s simple but worthwhile automated management to outperform my own overly complacent investing style, and to more than pay for the company’s fees. Much like this blog’s Lending Club Experiment (now well past the two year mark), I’ll set up a dedicated page where we can keep track of things in detail and compare Betterment results after fees to my default investment, which would have a two lump-sum purchase of Vanguard’s Total Stock Index(VTSAX) and Total International (VTIAX) funds.

Update: I have now set up this page, and you’ll find it here:

The Betterment Experiment – Results

As always, you are welcome to follow along with your own investment. If you do so with the banner below, this blog will benefit (and thanks!)

But even if you aren’t ready to invest at this time or need a few more opinions, I would suggest that the service could provide value to almost any US-based Mustachian. Put it onto your list of things to research further – I’m glad I did.

Conflict of Interest Warning! After this post came out, many described it as reading like an advert for Betterment and accused me of becoming a sellout. That’s a fair opinion and if you hold it, you should probably hold all of my recommendations as suspect. To be clear on the background, I did not get paid to write this or any other post. I just like the way this company works, so I invested a good chunk of my own savings with them and thought it was worth telling you about it.

But since they have a referral program, I signed up for it just as I always do for services I happen to use (Capitalone360, Republic Wireless, Lending Club, etc). Other things have no referral program (Vanguard, the public library, Costco, bicycling) and yet they get the same recommendation. But it’s a fine line to walk, and I have appreciated the callouts from readers to watch it – it is much better to sacrifice potential income than credibility and reputation.

Footnotes:

* in the US, anyway. Luckily they have finally reached Canada – learn more in Mr. Frugal Toque’s article on Canadian Investing. And in the UK, where you can get great education and investing knowledge by reading anything from my friend The Monevator.

** In fact. Vanguard founder John Bogle has done so much in his long career for the individual investor and for business ethics as a whole that he is up for a presidential medal of freedom. I’d say he is a good candidate. You can read more about it in this story on Jim Collins’ site. I also wrote a bit about Mr. Bogle in the article called “Enough”.

I’ve always been a do-it-yourself investor. This habit started around age 19 with a series of ridiculous speculative trades in individual high-tech company stocks. “This stock is sure to go through the roof”, I would think, “because their products are so great.”

I’ve always been a do-it-yourself investor. This habit started around age 19 with a series of ridiculous speculative trades in individual high-tech company stocks. “This stock is sure to go through the roof”, I would think, “because their products are so great.”